We Do Legal

Inside the Deal: Sydney Mergers & Acquisitions Legal Landscape

Navigation

- What's Really Happening in Australian M&A Right Now?

- The Big Legal Shake-Up Coming in 2026

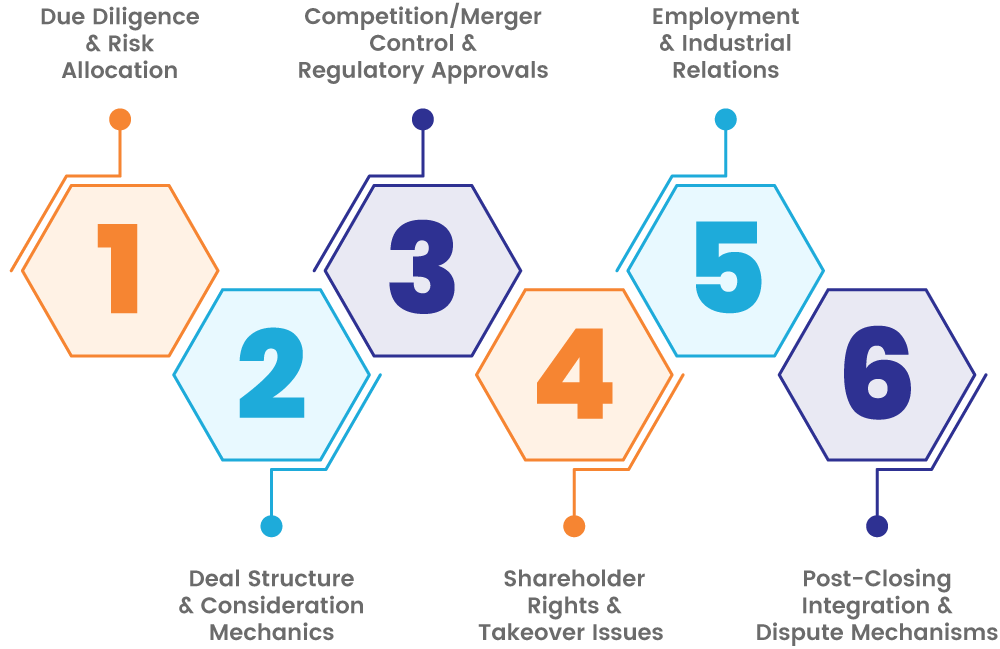

- The Six Legal Areas That Make or Break M&A Deals

- 1. Due Diligence & Risk Allocation (AKA: Actually Checking What You're Buying)

- 2. Deal Structure & Consideration Mechanics (AKA: How to Pay and Not Get Hammered by Tax)

- 3. Competition/Merger Control & Regulatory Approvals (AKA: Getting Permission from the Government)

- 4. Shareholder Rights & Takeover Issues (AKA: What Happens to Minority Shareholders)

- 5. Employment & Industrial Relations (AKA: What Happens to the Staff)

- 6. Post-Closing Integration & Dispute Mechanisms (AKA: Making Sure You Actually Get What You Paid For)

- What Most Businesses Get Wrong

- Quick Self-Check: Are You Ready for M&A?

- The Bottom Line

- Ready to Get Started?

- References

When Million-Dollar Dreams Turn Into Nightmares

Picture this: It’s 9:47 AM on a beautiful September morning in Bondi Junction. The partners of a growing tech company just got the phone call they’d been dreaming of.

A big private equity firm wants to buy their business for $45 million. Sounds amazing, right?

Fast forward six months – and it’s a complete disaster.

The deal fell apart when someone discovered $3.2 million worth of environmental problems with their building. Nobody had checked properly. The buyers walked away. Legal bills hit $480,000. The company’s reputation was damaged. Eventually, they had to sell for 40% less than the original offer.

“Here’s the brutal truth: The difference between M&A success and expensive failure usually comes down to getting the legal stuff right from day one.”

What's Really Happening in Australian M&A Right Now?

- Q1 2025: 187 deals worth US$11.7 billion

- Q2 2025: 169 deals worth US$35.6 billion

- Q3 2025: 161 deals with an average size of $159.12 million

Let’s talk numbers for a second. The Australian M&A market is actually pretty busy:

- Foreign buyers are pulling back. They went from doing 56% of deals in 2023 down to just 34% in 2024. That's a massive drop.

- Cash is king. About 70% of all deals now use cash instead of shares or other fancy arrangements.

- The rules are changing big time. Starting January 1, 2026, the ACCC (Australia's competition watchdog) is bringing in new mandatory rules that will completely change how M&A deals work.

The Big Legal Shake-Up Coming in 2026

- No more "ask for forgiveness later." Currently, many deals can close first and deal with regulators later. From 2026, you'll need approval BEFORE you can complete many deals.

- It's going to cost more. Notification fees range from $56,800 to $1.595 million depending on your deal size.

- It's going to take longer. You'll be waiting 30-90 business days for approval on deals that meet certain thresholds.

Many businesses don’t realise how much this will change their M&A plans. If you’re thinking about buying or selling, you need to factor this in now.

The Six Legal Areas That Make or Break Mergers & Acquisition Deals

Let’s break down the six critical areas where deals typically succeed or fail. Don’t worry – we’ll keep this practical.

1. Due Diligence & Risk Allocation (AKA: Actually Checking What You're Buying)

What it really means: Before you buy a business, you need to properly investigate what you’re getting. Think of it like getting a building inspection before buying a house, but way more complicated.

Why it matters: Remember our Bondi Junction disaster story? That’s what happens when due diligence goes wrong.

Here's a real example:

A Sydney buyer spent $85,000 on proper environmental checks and discovered $2.8 million in contamination problems. They used this to renegotiate the price and avoid a massive headache later.

| Factor | Comprehensive Due Diligence | Limited Due Diligence |

|---|---|---|

| Timeline | 8-12 weeks for thorough review | 3-4 weeks with restricted scope |

| Issue Discovery Rate | 85% of material liabilities identified pre-signing | 45-55% of issues remain undiscovered until post-completion |

| Success Rate | 92% successful completion rate | 68% completion rate due to post-signing issues |

| Legal Costs | $180,000–$350,000 for comprehensive review | $75,000–$120,000 upfront; potential litigation costs $500,000+ |

| Warranty Claims | 15% of transactions experience warranty claims averaging $650,000 | 42% experience claims averaging $2.1 million |

- Comprehensive due diligence: 92% of deals complete successfully

- Limited due diligence: Only 68% complete without major problems

- Proper checking finds 85% of major issues before signing

- Cutting corners means 45-55% of problems only surface after you've bought the business

“Bottom line: Every dollar spent on proper due diligence saves about five dollars in problems later.”

2. Deal Structure & Consideration Mechanics (AKA: How to Pay and Not Get Hammered by Tax)

What it really means: There are different ways to structure a deal, and each has different tax implications. Get this wrong and you could be paying way more than you need to.

The two main options:

- Buying shares: You buy the company itself

- Buying assets: You just buy the bits of the business you want

Here’s why it matters:

| Structure Element | Share Acquisition | Asset Acquisition |

|---|---|---|

| Stamp Duty (NSW) | 0.25% of consideration for unlisted companies | 5.5% on real estate plus rates on other dutiable assets |

| GST Treatment | Input taxed (no GST on share transfer) | GST applicable unless going concern exemption applies (Division 11) |

| Liability Assumption | Acquirer inherits all company liabilities | Only specifically assumed liabilities transfer |

| Employee Transfer | Employment contracts continue automatically | May trigger transfer of business provisions (Fair Work Act s311) |

| Tax Losses | May be available subject to continuity tests (s165-10 ITAA 1997) | Remain with vendor entity |

Many businesses find this tricky because there’s no one-size-fits-all answer. The best structure depends on your specific situation.

3. Competition/Merger Control & Regulatory Approvals (AKA: Getting Permission from the Government)

This is where the 2026 changes really bite.

What triggers the new rules?

The government hasn’t made this easy to understand, but roughly:

- Combined Australian turnover over $200 million, AND

- Target's Australian turnover over $50 million, OR

- Combined global turnover over $500 million

The new timeline looks like this:

ACCC Review Process

- Phase 1 (30 business days): Basic review

- Phase 2 (90 business days): Detailed review for complex deals

- Public Benefit Assessment (50 business days): Available in special circumstances

| Approach | Pre-notification Engagement | Direct Notification |

|---|---|---|

| Preparation Time | 2-4 weeks pre-lodgement discussion | Immediate lodgement with statutory timeframes |

| Certainty Level | Higher predictability of review timeline and requirements | Greater uncertainty; potential for extended Phase 2 review |

| Success Rate | 89% Phase 1 clearance rate with pre-engagement | 67% Phase 1 clearance rate without pre-engagement |

| Total Cost | Additional preparation costs offset by reduced delay risk | Lower upfront costs but higher risk of project delays |

Pro tip: Businesses that engage early with the ACCC get approval in Phase 1 about 89% of the time. Those who don’t? Only 67%.

Foreign Investment (FIRB) thresholds are complicated and change every year. For 2025, they range from $0 for sensitive businesses up to $1.464 billion for non-sensitive businesses from friendly countries.

Here’s what you need to remember: You need FIRB approval BEFORE you sign a binding agreement, not just before completion.

“The reality: These new rules are the biggest shake-up to Australian M&A law in over 20 years.”

4. Shareholder Rights & Takeover Issues (AKA: What Happens to Minority Shareholders)

The key rule: If you own 90% or more of a company (and meet some other requirements), you can force the remaining shareholders to sell to you.

But here’s the catch: You need exactly 90% by number of shares, not by value. Many people get this wrong.

| Ownership Level | Available Rights | Minority Protection | Compulsory Acquisition |

|---|---|---|---|

| 90%+ Ownership | Compulsory acquisition rights under s661A | Limited to fair value objections | Available following successful takeover bid |

| 75–89% Ownership | Special resolution control; cannot compulsorily acquire | Full minority protection rights under s232–234 | Not available; requires additional acquisitions |

| 50–74% Ownership | Board control; ordinary resolution control | Full oppression remedies available | Not available |

Schemes of arrangement (a different way to buy companies) need approval from:

- 75% of shareholders by value, AND

- 50% of shareholders by number

This is trickier than it sounds because you need both tests, not just one.

5. Employment & Industrial Relations (AKA: What Happens to the Staff)

Here’s what catches many buyers off guard: When you buy a business, you often inherit all the employment obligations, including enterprise agreements with unions.

The Fair Work Act says: If employees transfer to you as part of a business transfer, you have to honour their existing conditions.

New rules from February 2025: Casual employees can now request to become permanent employees in certain circumstances.

Enterprise agreements are particularly tricky because:

- They automatically bind you as the new employer

- You usually can't change them for the first 12 months

- You need to consult with unions for major changes

“The reality: Employment-related costs often add 12-18% to the total acquisition cost in service businesses.”

| Workforce Type | Agreement Obligations | Consultation Requirements | Integration Timeline |

|---|---|---|---|

| Enterprise Agreement Coverage | Agreement binds successor employer (s311) | Formal union consultation required for major changes | 12–18 months for significant restructuring |

| Award-Only Employees | Modern award applies with individual arrangements | Individual consultation sufficient for most changes | 6–9 months for integration completion |

| Mixed Workforce | Hybrid obligations create complexity | Staged consultation approach required | 9–15 months depending on agreement overlap |

"Employment law compliance in M&A transactions requires early assessment and careful planning. The costs of getting it wrong extend far beyond financial penalties to operational disruption and reputational damage."

Fair Work Ombudsman Anna Booth

6. Post-Closing Integration & Dispute Mechanisms (AKA: Making Sure You Actually Get What You Paid For)

Here’s an uncomfortable truth: About 68% of acquisitions have some kind of dispute after completion.

The average warranty claim: $2.4 million in mid-market transactions.

That’s why you need good dispute resolution mechanisms:

| Mechanism | Resolution Timeline | Cost as % of Dispute Value | Success Rate | Enforceability |

|---|---|---|---|---|

| Expert Determination | 3–6 months | 2–4% of disputed amount | 95% finality rate | High (binding determination) |

| Commercial Arbitration | 9–15 months | 8–15% of disputed amount | 92% finality rate | High (enforceable award) |

| Federal Court Litigation | 18–36 months | 20–35% of disputed amount | 78% finality rate (appeals possible) | Highest (court judgment) |

Escrow arrangements (where you hold back some of the purchase price) are standard practice:

- Usually 5-10% of the purchase price

- Held for 12-24 months

- Covers warranty claims and other problems

ACCC Merger Control Timeline

- Pre-Deal (8-12 weeks): Due diligence completion, regulatory pre-clearance discussions, employment law assessment, structure optimisation

- Signing to Completion (4-16 weeks): ACCC/FIRB approvals, condition satisfaction, employee consultation, final legal documentation

- Post-Completion (12-24 months): Integration execution, warranty period management, earnout monitoring, dispute resolution as required

Regulatory Coordination Case Study

A $280 million acquisition of an Australian telecommunications services provider required coordination across ACCC merger clearance, FIRB approval for the Singapore-based acquirer, and Australian Communications and Media Authority licensing transfer. Pre-clearance discussions with all three regulators, commenced eight weeks before signing, enabled parallel processing and completion within the target timeframe. Total regulatory approval cost: $145,000. Value of certainty achieved: immeasurable.

What Most Businesses Get Wrong

Analysis of over 200 mid-market Australian transactions reveals consistent patterns in client preparation gaps:

- Regulatory timeline compression: Many people still think they can close deals and deal with regulators later. The new rules change this completely.

- Employment law complexity: The Fair Work Act creates way more obligations than most people realise. It's not just about keeping employees – it's about honouring all their existing conditions.

- Hidden integration costs: Budget an extra 3-7% of the deal value for integration costs. IT systems, compliance alignment, and cultural integration add up fast.

"Successful M&A execution requires treating legal and regulatory requirements as design parameters, not obstacles. Early engagement with specialist counsel improves transaction outcomes measurably."

Partner, Major Australian Law Firm

Quick Self-Check: Are You Ready for M&A?

Understanding your M&A readiness helps identify legal, financial, and operational gaps before they become costly problems. This quick self-assessment highlights where your business stands and what steps you can take to improve transaction outcomes.

The Bottom Line

Australian M&A is getting more complex, not simpler. The new ACCC rules starting in January 2026 are just the beginning.

Here’s what the data shows about getting proper legal help early:

- 35% reduction in total transaction costs

- 50% fewer post-completion disputes

- 25% faster completion times

The cost of getting it wrong extends far beyond legal fees. It can destroy deals, damage reputations, and cost millions in unexpected liabilities.

"In the modern Australian M&A environment, legal expertise is not a service provider relationship—it is a strategic partnership essential to value creation and risk management."

President, Law Council of Australia

Ready to Get Started?

If you’re considering an M&A transaction in Bondi Junction, Sydney, or anywhere in Australia, contact Lazarus Legal for a comprehensive assessment.

We help with:

- Comprehensive Due Diligence Management: Leading vendor and purchaser due diligence across all legal disciplines, with particular expertise in technology, healthcare, and manufacturing sectors prevalent in the Bondi Junction business community.

- Regulatory Clearance Coordination: Managing ACCC merger notifications, FIRB approvals, and sector-specific regulatory clearances under the new mandatory regime commencing January 2026.

- Transaction Structure Optimisation: Designing tax-efficient transaction structures with comprehensive consideration of stamp duty, GST, and income tax implications across all Australian jurisdictions.

- Employment Law Integration: Addressing transfer of business obligations, enterprise agreement complexities, and workforce integration challenges under the Fair Work Act 2009.

- Post-Completion Enforcement: Implementing robust dispute resolution frameworks, escrow arrangements, and earnout enforcement mechanisms to protect your transaction investment.

Our commercial lawyers understand the Bondi Junction business community and have deep experience in technology, healthcare, and manufacturing M&A.

If your readiness score is below 12, or you’re planning a transaction over $50 million (which triggers the new ACCC rules), don’t wait. Get proper legal advice now.

The M&A landscape is changing fast. Make sure you’re prepared for what’s coming.

Need help with M&A legal issues? Our litigation lawyers can also assist if you’re facing post-completion disputes or warranty claims.

References

- S&P Global Market Intelligence, "Australia M&A By the Numbers: Q1 2025" (29 May 2025)

- S&P Global Market Intelligence, "Australia M&A By the Numbers: Q2 2025" (29 August 2025)

- HLB Mann Judd, "Australian M&A Review Q3 2025" (2025)

- Norton Rose Fulbright, "Australian public M&A deal trends report 2025" (April 2025)

- Australian Competition and Consumer Commission, "Merger control regime" (2025)

- Corporations Act 2001 (Cth) s 661A

- Foreign Investment Review Board, "Monetary thresholds" (3 January 2025)

- Competition and Consumer Act 2010 (Cth)

- Fair Work Act 2009 (Cth) ss 311–324

- Australian Securities and Investments Commission, "Regulatory Guide 5: Relevant interests and substantial holding notices" (March 2024)

- Takeovers Panel, "Guidance Note 1: Declaring a takeover situation unacceptable" (10th edition, April 2021)

- Fair Work Ombudsman, "2025 Compliance and Enforcement Policy" (2025)

This article is for general information only and doesn’t constitute legal advice. Get specific legal advice for your situation. All information is current as of October 2025.

Share post